Table of Content

(500 views)

Quick Summary

Peer-to-peer lending apps have become the latest trend, offering a more efficient and faster alternative to traditional loan methods. These peer-to-peer lending platforms are gaining traction because they provide significant benefits for both borrowers and lenders, making them the go-to option for many. In this article, we’ll explore the features and advantages of a peer-to-peer lending app, along with how it works, why businesses should invest, and much more.

Introduction

In the past, borrowing money from banks seemed like a simple task. However, the growing threat of fraud, along with long approval processes and lengthy queues, has made traditional loan systems increasingly inefficient. With the advent of mobile technology and peer-to-peer lending apps, obtaining a loan has never been easier. These apps have revolutionized the lending process, allowing borrowers and lenders to directly interact without the need for intermediaries, such as banks or credit unions.

A peer-to-peer lending system enables individuals or businesses to borrow and lend money directly, bypassing traditional financial institutions. This creates a more streamlined and cost-effective process, benefiting both parties involved. With the help of peer-to-peer lending software, the entire transaction process becomes much more efficient and secure. In this article, we’ll delve deeper into the features of peer-to-peer lending platforms, the way they work, and why they’ve become so popular among users.

What is a Peer-to-Peer Lending App?

A peer-to-peer lending app is a financial technology platform that connects borrowers directly with lenders, allowing them to bypass traditional intermediaries, such as banks. In this system, individuals or businesses can lend or borrow money without the involvement of a bank or loan agency. Since there are no middlemen, the lending process becomes more affordable and efficient. This is why P2P loan apps are becoming increasingly popular, as they offer low fees and greater financial flexibility for both lenders and borrowers.

The peer-to-peer lending platform software facilitates seamless transactions, making it possible for lenders to invest in borrowers who meet their criteria, and for borrowers to obtain funds quickly. The app or platform handles all the logistics, from loan applications to repayments, allowing for a hassle-free experience.

How Does Peer-to-Peer Lending Work?

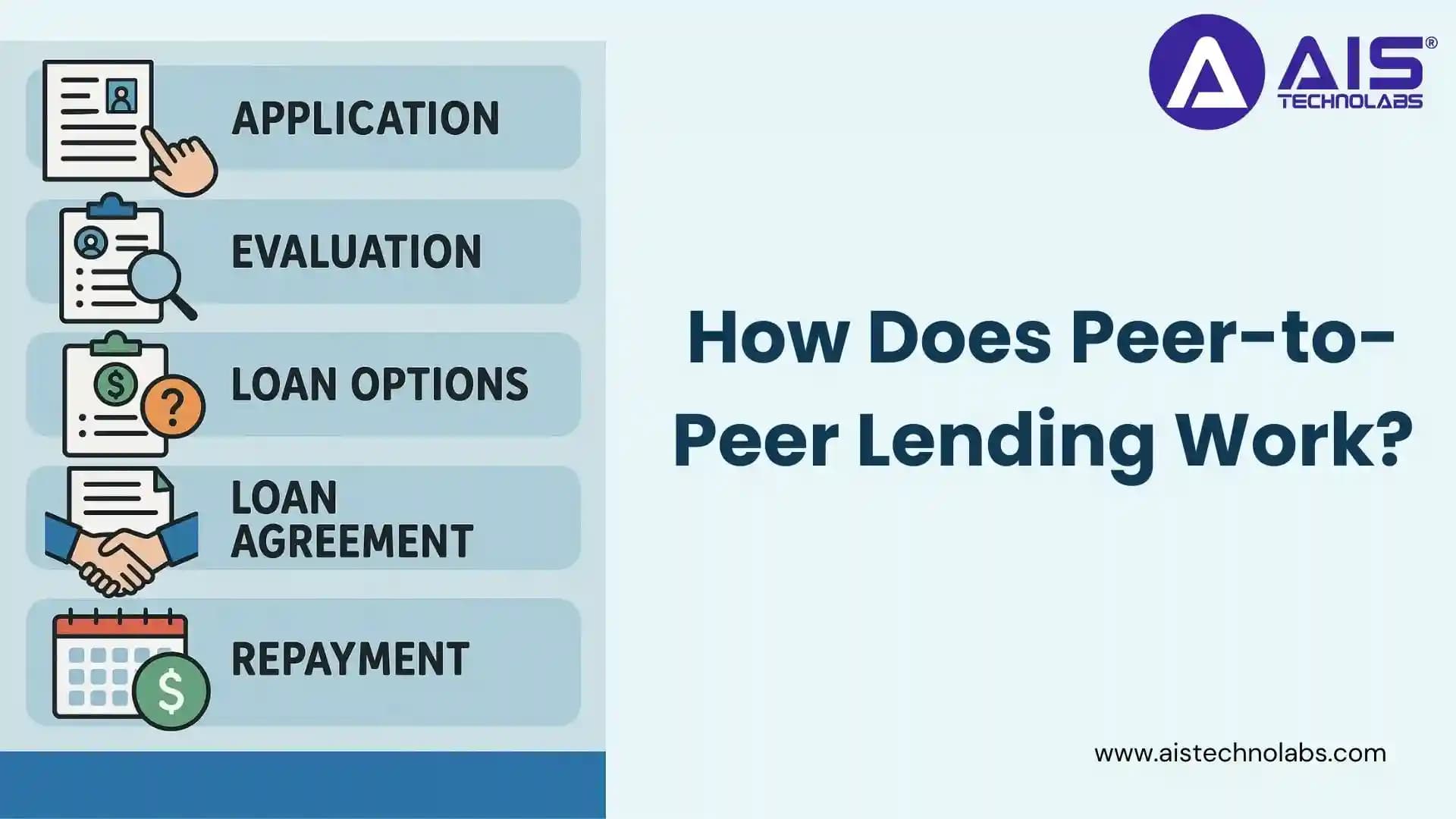

Before using a P2P loan app, you should understand how the process works. Here's a breakdown of how peer-to-peer lending applications operate:

- Application: A borrower fills out an online loan application through the peer-to-peer loan software or platform.

- Evaluation: The platform evaluates the borrower’s creditworthiness and assesses the associated risks.

- Loan Options: Based on the borrower’s credit rating, investors are offered different loan options with competitive interest rates.

- Loan Agreement: Once the loan reaches full funding, the borrower accepts the terms and conditions.

- Repayment: The borrower repays the loan with interest, typically on a monthly basis. Timely repayments can positively affect the borrower’s credit score.

For lenders, it’s important to note that peer-to-peer lending apps offer low-interest rates compared to traditional financial institutions. Since there are no intermediaries, both the lender and borrower benefit from more favorable rates.

Benefits of Peer-to-Peer Lending Apps for Borrowers

- Flexibility: Peer-to-peer loans often don’t require collateral, making them a more flexible option for borrowers who may not have assets to offer as security. The application process is faster and more straightforward than traditional loan methods.

- Thorough Screening: Although P2P lending platforms don’t require collateral, they still perform a comprehensive evaluation of borrowers’ financial health, such as reviewing tax identification numbers and other financial records. This ensures trust and security for all parties.

- Lower Fees: With no banks or financial institutions involved, peer-to-peer lending apps keep costs low, providing borrowers with better loan terms and interest rates.

- Quick Access to Funds: Since the process is handled digitally through the P2P lending app, borrowers can access the funds more quickly than with traditional loan methods.

Benefits of Peer-to-Peer Lending Apps for Lenders

- Multiple Investment Choices: Lenders can choose from various types of borrowers based on their preferences, such as credit scores, risk profiles, and loan terms. With a peer-to-peer lending platform software, lenders can carefully select their investments.

- Fraud Prevention: Many P2P loan apps include fraud prevention systems to ensure that lenders’ investments are safe. Strict internal systems help minimize risks and safeguard against fraud.

- Attractive Returns: On average, peer-to-peer lending platforms offer higher returns on investments compared to traditional financial institutions. A typical peer-to-peer lending app can offer an annual return rate of 10%, depending on the loan type and duration.

Why Should Businesses Invest in Peer-to-Peer Lending Apps?

Investing in peer-to-peer lending platforms is a great opportunity for businesses and individuals looking to diversify their portfolios. The global P2P lending market is expected to grow exponentially, with a projected market size of $558.91 billion by 2027. These platforms cater to small and medium-sized businesses (SMEs), student loans, and personal loans, offering flexible options for borrowers and high returns for lenders.

Small to mid-sized investors and borrowers benefit from the minimal cost of using peer-to-peer lending apps. Online platforms eliminate the need for costly infrastructure, making them a low-cost alternative to traditional lending.

Major Features of Peer-to-Peer Lending Apps

For a peer-to-peer lending application to succeed, it must include several key features that cater to both borrowers and lenders. Below are some important features of a peer lending app.

Features for Borrowers:

- Sign Up: Borrowers must create an account and provide relevant details, such as their financial status and personal identification.

- Loan Market: Once the borrower’s application is approved, their loan is listed on the platform’s loan market, where lenders can offer competitive rates.

- Loan Acceptance: The borrower selects a loan based on the interest rate and terms offered by the lenders.

- Repayment: The loan repayment is structured with clear monthly installments, allowing the borrower to plan their payments accordingly.

Features for Lenders:

- Sign Up: Lenders create an account and fund it with their desired investment amount.

- Loan Selection: Lenders can browse available loan listings and select borrowers based on their creditworthiness and loan criteria.

- Repayment: Lenders receive regular payments of principal and interest. They can reinvest these funds into new loans, continuing to earn returns.

Peer-to-Peer Lending Platforms and White-Label Solutions

For businesses that want to launch their own peer-to-peer lending platform, white-label solutions are available. A white-label P2P lending platform allows businesses to customize an existing peer-to-peer lending app to suit their branding and user needs. These solutions provide a cost-effective way to enter the P2P lending space without having to develop an app from scratch.

Some businesses may prefer to use open-source P2P lending software, which can be customized for specific needs. Open-source platforms are a great way to start your own lending platform with fewer upfront costs while still maintaining control over the application’s features.

Transform Your Lending Experience with Our Peer-to-Peer App Solutions

Why Choose AIS Technolabs for P2P Lending App Development?

When seeking an ideal development partner for your peer-to-peer lending app development, AIS Technolabs is your trusted choice. Our team of experts can help you build a peer-to-peer lending application that is both secure and user-friendly. We offer P2P loan app development, providing fully customizable, feature-rich peer-to-peer lending apps designed to meet the needs of both borrowers and lenders. With years of experience in the industry, we guarantee world-class solutions for your P2P lending platform.

Conclusion

Peer-to-peer lending app development is transforming the lending industry by offering a streamlined process with lower fees for borrowers and attractive returns with less risk for lenders. As the market for P2P loan apps continues to grow, both borrowers and lenders have exciting opportunities ahead.

Whether you're looking to invest in peer-to-peer lending platform software or develop a white-label P2P lending platform, the advantages are clear. Choose a reliable development partner to ensure your peer-to-peer lending application meets high standards.

At AIS Technolabs, we specialize in P2P loan app development. Our expert team is ready to turn your peer-to-peer lending app idea into a secure, scalable solution. Contact us today for a tailored estimate and development plan!

FAQs

Ans.

A peer-to-peer lending app connects borrowers directly with lenders, eliminating intermediaries like banks and offering a streamlined, cost-effective borrowing process.

Ans.

Borrowers apply for loans on the app, which are then evaluated by investors. Lenders can choose to fund loans based on borrower profiles and risk assessment.

Ans.

Borrowers enjoy lower fees, flexible terms, no collateral requirements, and faster approval compared to traditional loan options.

Ans.

Lenders can choose borrowers based on risk profiles, enjoy attractive returns, and benefit from reduced intermediary fees.

Ans.

You can work with a professional development team like AIS Technolabs to create a custom peer-to-peer lending app tailored to your business needs.

Ans.

A white-label P2P lending platform is a customizable software solution that allows you to brand and launch your own lending app without developing it from scratch.

Mary Smith

Mary Smith excels in crafting technical and non-technical content, demonstrating precision and clarity. With careful attention to detail and a love for clear communication, she skillfully handles difficult topics, making them into interesting stories. Mary's versatility and expertise shine through her ability to produce compelling content across various domains, ensuring impactful storytelling that resonates with diverse audiences.